DueDEX.com Review – Scam or Not?

DueDEX is a Bitcoin derivative trading platform, which offers perpetual swap contracts with up to 100x leverage. The trading platform’s primary focus is on currency swaps for Bitcoin and the US dollar without charging you massive fees for BTCUSD trades.

The platform provides high speed and fair crypto derivatives with competitive fees on the market. Multiple security measures are in place to keep your funds safely while at the same time their market makers make sure there is always deep liquidity offered on the trading platform. This is especially supported with their maker rebate fee schedule. Trades are executed quickly with no downtime. And last, but not least, you can earn up to $70 with their welcome bonus system if you sign up to open an account now.

DueDEX derivative crypto trading platform has been on the market since early 2019, let’s see what the platform can offer.

About DueDEX

The company behind DueDEX was founded in 2018 by Bo Wang, a young entrepreneur, and technologist, who has 5+ years of experience in the blockchain sector. The company is supported by a strong and experienced team, and its members are coming from the technology and financial services sector. Ada Gao, DueDEX’s community manager, for example, has been working as a VP at Citibank for 8 years, before joining the cryptocurrency space.

The company is officially registered in Belize, and it markets itself as a fair and high speed trading platform. Its websites are available in two languages: English and Chinese. Unfortunately, public information cannot be found about the company offices or any other local presence. No official security audit or compliance audit was published by the team, which is not uncommon in the sector, but those kinds of certifications always increase trust and security in the given service.

The platform does not provide service to clients in restricted areas, including Hong Kong, Cuba, Iran, North Korea, Crimea, Sudan, Malaysia, Syria, Bangladesh, Bolivia, Ecuador, and Kyrgyzstan. In addition to this list, DueDEX also excludes customers from the United States because of the local regulation affecting cryptocurrency exchanges and derivative trading sites.

The platform is relatively active in social media as well. On Twitter they have around 13k followers, and they tweeted 431 times in the last 8 months since they registered their account. Besides the Twitter, DueDEX is available on Facebook, although it seems to be a fairly new account with only a handful of followers. You can check the company on their official Linkedin page. They also run a Medium blog where you can find daily news. On Reddit, you can find them on r/DueDEXOfficial where they often share product updates and guides of the platform.

Creating an account at DueDEX

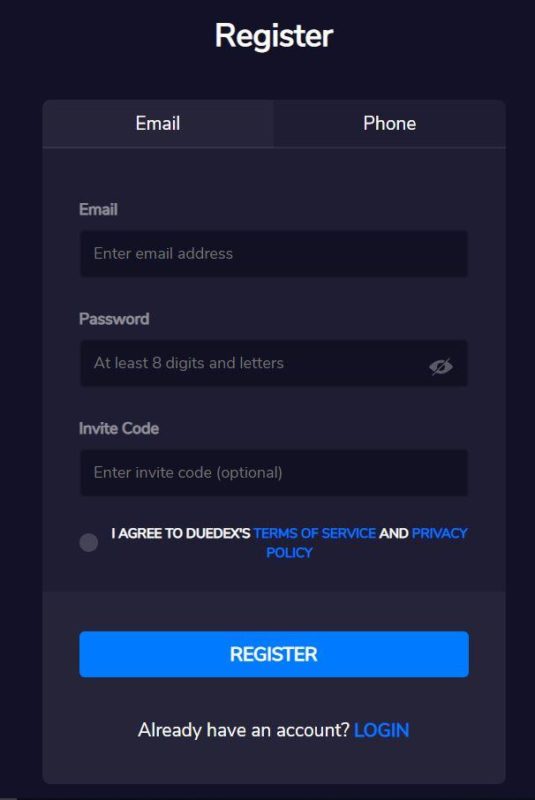

Creating an account at DueDEX is a very simple and easy process and only takes about 30 seconds. You can select one of the two options, you can register either with your email address or with your phone number. After you typed your email address and password, and you have accepted the terms and conditions, a verification email is sent to your mailbox. By clicking on the activation link in the received email, the registration is successfully finished and completed, you are ready to use the trading platform.

The phone registration is even simpler because you only need to provide the code sent to you by SMS.

Immediately upon creating an account 2FA is turned on to ensure full security, and a 2FA activation code sent to your mailbox that must be copied before you can access any feature of the platform.

The bright side of the platform is that it does not force you to undertake any KYC verification process. No need to provide any personal identification documents, any passports or IDs cards and also they do not require to submit proof of residence. The KYC process is not even needed for withdrawals, like in case of many other exchanges, so you can deposit, trade and withdraw with a single email address. Of course – only in crypto. Fiat deposits or crypto purchases are not offered on DueDEX.

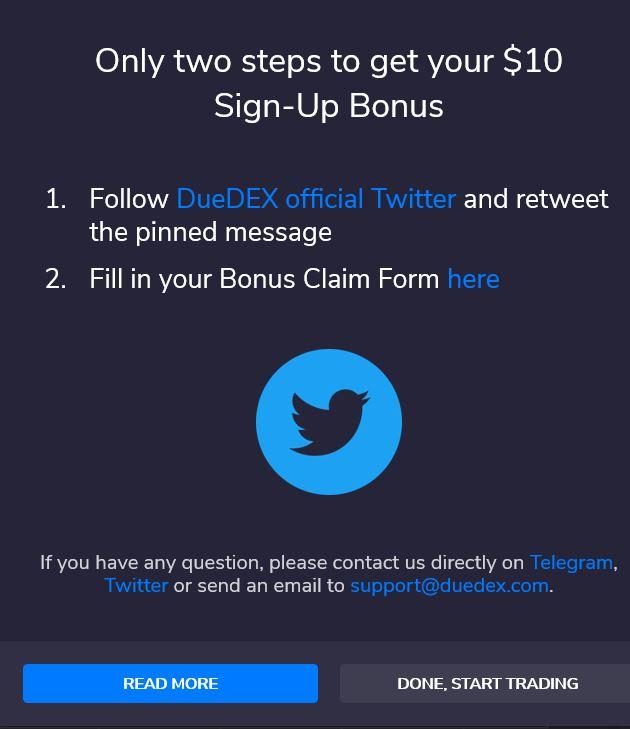

After you logged in, the first positive surprise will await you. A tab will pop up showing you, that if you follow the company on Twitter and you fill in your Bonus claim form, a $10 Sign-up Bonus will be credited to your balance. Not bad for a couple of clicks, right?

You can start trading with the bonus amount, and in case of success, the trading profits gained on the bonus can be withdrawn immediately.

Deposit on DueDEX

As of now DueDEX does not accept any deposits of fiat currency, only BTC is allowed. Altcoin deposits might become possible at some point in the future, we’ll see.

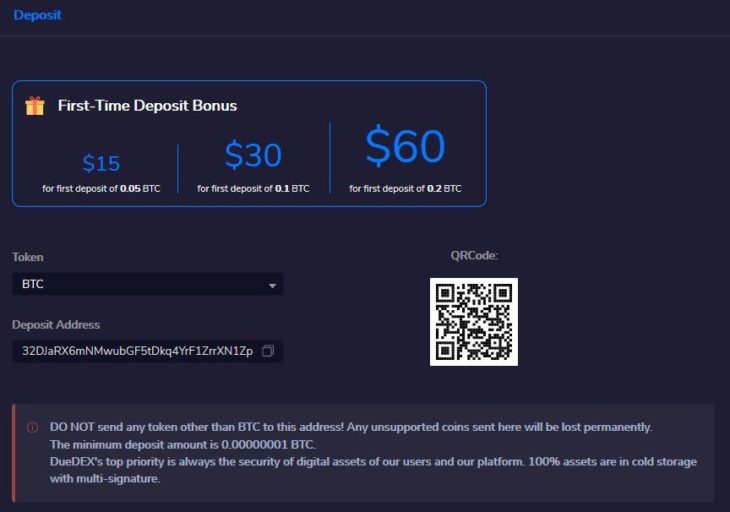

You can easily transfer your Bitcoin with a minimum amount of 0.00000001 BTC (1 satoshi) to your account by reading the QR code or copying the deposit address to your wallet. Make sure you don’t transfer any other token than BTC because unsupported cryptocurrencies will be lost forever. The low deposit amounts let you try out the features of the platform without taking significant financial risk.

Next to the Sign-up Bonus the platform also offers an additional First-time Deposit Bonus. You get rewarded up to $60 upon completing your first deposit. If you deposit 0.05 BTC, you get $15 a bonus. You receive $30 when you top up 0.1 BTC. $60 credit is automatically added to your balance, if the deposit value is at least 0.2 BTC.

Even though there is almost no deposit minimum on DueDEX because of the first deposit bonus you might want to consider adding more funds to your account to max out the deposit bonus offer. Bear in mind however the minimum withdrawal amount set on the platform when depositing Bitcoin on DueDEX.

Withdrawals on DueDEX

DueDEX offers very competitive withdrawal fees. You will have to pay only 0.0001 BTC for a transaction, which goes to the miners on the BTC network, no additional fee is charged on you. The minimum withdrawal amount is 0.001 BTC, and the platform is processing withdrawals 3 times a day at 0:00, 8:00, 16:00 (UTC).

Trading on DueDEX

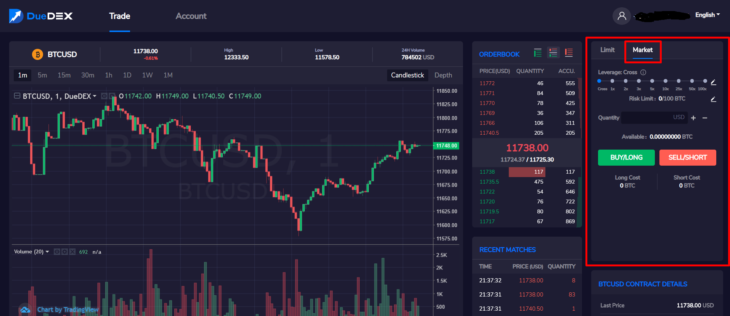

Specialized in derivative cryptocurrency trading, DueDEX offers margin trading options up to 100x leverage. This means for every one dollar you trade with you get exposure to 100 dollars worth of cryptocurrency you can trade with. Bear in mind that margin trading is risky, although there is a high upside potential, your capital is at risk and in case the market turns against your strategy you can quickly lose your hard-earned profit.

Hence DueDEX is a derivative trading platform, you are not allowed to spot trade. The trading platform has ‘buy long’ and ‘sell short’ features through a limit order or market order (up to 100x leverage). This means that you can receive a higher exposure towards a certain cryptocurrency’s price increase or decrease, without having the assets you need. You do this by leveraging your trade, which in simple terms means that you borrow from the exchange to bet more.

A limit order means you agree to buy or sell a currency in the future at a designated price. For example, you believe Bitcoin will gain value from $8,000 to $8,500 by sometimes in 2020. You can enter a limit order authorizing DueDEX to sell your crypto when BTC hits $8,500. You can even use leverage to magnify your potential profits.

A market order allows you to buy or sell crypto in the future at the prevailing market prices. That way, you don’t have to wait until BTC moves up from $8,000 to $8,500. You can execute your order at your convenience.

For experienced traders, DueDEX provides stop limit and stop market to help close positions quickly and manage risk more efficiently. These features are located next to the limit and market trading icons. Seasoned traders can utilize the API trading feature as well, which provides a full-featured Restful and Websocket API to meet the demand of institutional traders. The API helps you to build your trading bot based on the exchange’s data.

For inexperienced traders, the platform offers a public testnet through new joiners can learn how to trade crypto and how to use the platform. The testnet has all the features like the live interface you see the liquidity and the live prices but you have the option to paper trade and test your trading strategies without risking any hard cash.

Trading Fees

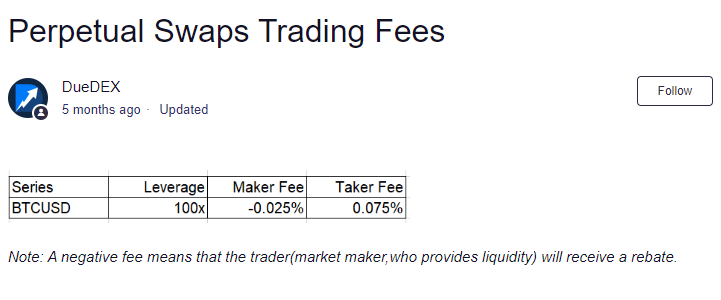

Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches the maker’s order. At DueDEX takers pay only 0.075%, while makers get paid to trade (negative trading fees, -0.025%). Market makers don’t pay trading fees because they provide liquidity to the DueDEX exchange. Instead, they receive a rebate of 0.025% for each trade.

Apart from the trading fees DueDEX also charges funding fees for leveraged trades. The funding fees are exchanged between the long and short position holders so it does not charged by DueDEX. The funding rate is recalculated every 8 hours along with the premium index and interest rate. DueDEX applies a cap on the funding rates that is the maximum 75% of the initial margin – maintenance margin.

Security and Reliability

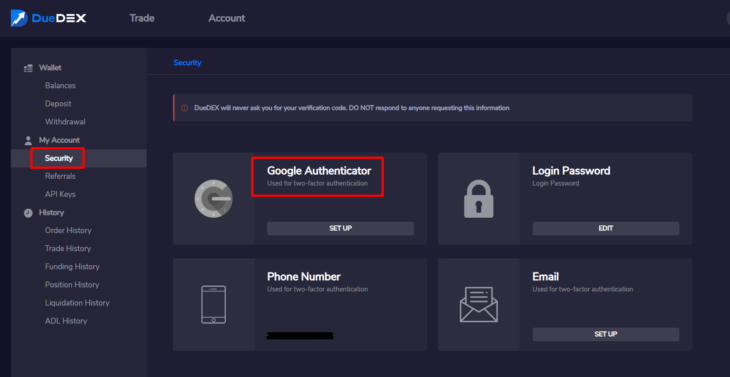

The platform is hosted on Azure DueDEX, which takes advantage of the Microsoft security framework. Assets are in cold storage with multi-signature wallets. Cold wallets are fully offline, and not accessible from the platform servers or Internet. Each and every withdrawal from DueDEX is audited by the platform staff. The cold wallet is being used during all processes, even the user’s deposit asset is received by a cold wallet address, leaving no chance for hackers at all.

The platform deploys other security measures as well. As we mentioned above, for the account login two-factor-authentication is automatically set. For all communication, the fully encrypted SSL connection is applied.

From the reliability perspective, the platform claims, that their trading engine is processing 100,000 transactions per second with low latency of less than 10ms. This enables fast trading execution with a minimal time lag that ensures high liquidity on the market.

DueDEX provides customer support through three main channels: Twitter, telegram and email. If you face any problem, you can submit your request via form directly on the website. They are working 24/7 live with multilingual and multi-channel customer service and try their best to get back to your issue as soon as possible.

Since DueDEX is a relatively new trading platform, currently there are not many reviews available online about their services, as clients have not shared yet their opinions. This also means there are no fraud reports or scam warnings have been disclosed yet. The lack of company information is always a red flag although DueDEX is trying to be as transparent with the fees and processes as it can be.

Conclusion

DueDEX is a relatively young derivative trading platform, launched only in 2019. Getting started on DueDEX takes only a couple of clicks, and you will be immediately rewarded with welcome bonuses and deposit bonuses. As of now, the platform supports only BTC deposits, which compared to the competitors it can be seen as a disadvantage. Although DueDEX has plans to introduce other cryptocurrencies as well. The good news, however, is that there is no KYC performed at all, so after signing up with an email address you are ready to fund your account and start trading within a minute. Even withdrawals do not require going through any KYC processes as there is no fiat payment offered on DueDEX.

Considering the trading, the platform offers go long or short positions using limit or market order. Due to the fact, that DueDEX is working with perpetual contracts with no expiry dates, you can close your trades at your convenience. However US investors are not permitted to trade on the platform.

One of the unique selling points of DueDEX is its fairness and transparency. All rules, formulas, and fees are open and transparent to every user, retail or API accessed professionals. The fees at DueDEX are extremely competitive which makes it attractive and reliable in the whole trading community. Once the company gains traction on the market and more and more people will use platform and probably more reviews and feedback will be available about their services.

So sign up with DueDEX and get your 70$ bonus today.

Pros:

- low trading fees (rebates for market makers!)

- no KYC process

- sign-up and deposit bonuses

Cons:

- no information about the company

- no fiat trading option

- new trading platform with no real social media activity