Best Bitcoin Options Exchanges

Bitcoin options are a growing field in the cryptocurrency space enable traders to speculate on the future movements of bitcoin prices. The options market size just hit new records this year by achieving the monthly volume of over 600 billion dollars on bitcoin option exchanges. Definitely something worth considering, if you are looking for making profits in cryptocurrency trading.

We are going to deep dive into bitcoin options, how can you profit from them and what are the best places to trade with options using bitcoin.

Review Contents

What is a Bitcoin option?

How to trade Bitcoin options?

Advantages of Bitcoin Options

Disadvantages of Bitcoin Options

Top 6 Bitcoin Options Exchanges

What is a Bitcoin option?

First, let’s start with options. An option is a derivate contract that gives the holder the right to buy or sell the underlying asset at a future date. In case of bitcoin options, the underlying asset is bitcoin. You can speculate on the future price movements of bitcoin by paying (or receiving) an option premium at the current time.

It is important to understand an option is an opportunity, a right you can decide to exercise at a future date. In contrast, futures contract which also lets you speculate on the future price of the underlying asset does not give you the optionality to enter into the contract, but it is an obligation you set at present.

Options are always two-sided contracts: there are a buyer and a seller of the option contract. When you are buying an option (or go long), you buy the optionality it gives you in trading that you can later decide to exercise or not. If you decide to sell an option (or go short), you will have to buy or sell the underlying asset at the agreed date, no matter what happens on the market. In order to get into a contract like this, you can buy the optionality for a premium. On the other way around, you can sell the option to generate cashflow through the premium, but in this case, you no longer have the optionality – see more about this below.

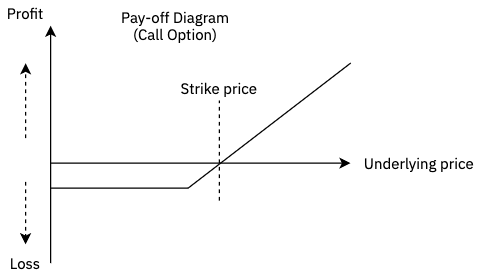

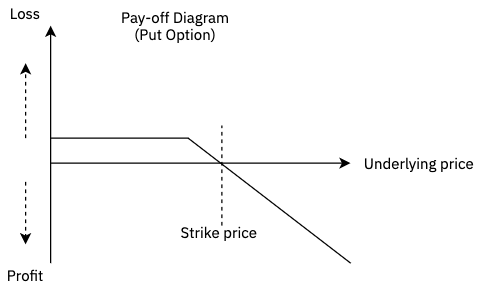

In terms of market view, there are call and put options. Call options give you the right to buy bitcoin in the future at a rate set today. Put option is a right to sell bitcoin in the future at a rate set today.

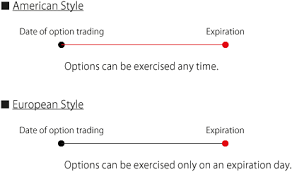

In terms of exercise date, there are American and European style options. Exercise date is the date when the optionality of the option contract can be executed. In the case of a European style option, you can only execute the optionality at the end of the contract, while if you own an American style option, you can decide at any point in time to execute the contracts. Since American style options have the extra exercise optionality, they are always priced higher than European options.

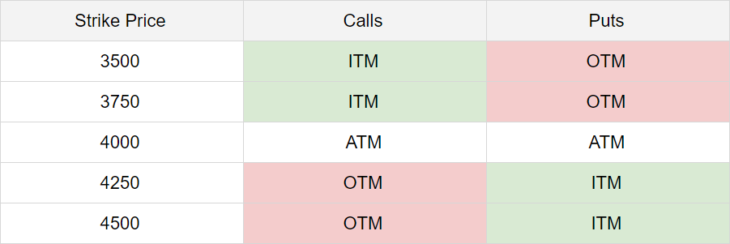

In terms of the underlying asset price and exercise price, we can talk about ITM (in the money), ATM (at the money), and OTM (out of money) options. ATM options mean at the current market price of bitcoin is equal to the exercise price of the option. (The exercise price is the preset price you agreed with the counterparty to execute the options in the future). ITM option means at current market rate the option has value as if exercised today it would result in a profit. OTM options, on the other hand, are currently not worth exercising but can be done so in the future with profit, in case the market moves in the desired direction.

There are many different forms of options. As a start, we recommend you to get familiar with the basic option types and how they work and only move to more exotic products when you are already comfortable about how bitcoin options work. Make sure you understand how options are priced, otherwise it can cause you unnecessary losses.

How to trade Bitcoin options?

You can buy and sell call and put options, just like any other assets, they have their own market price which is depending on the price of the underlying asset. To be more precise, there are a lot of different option pricing models to get to the fair market value of the options, but at the end, the price of the options are determined by market forces: supply and demand.

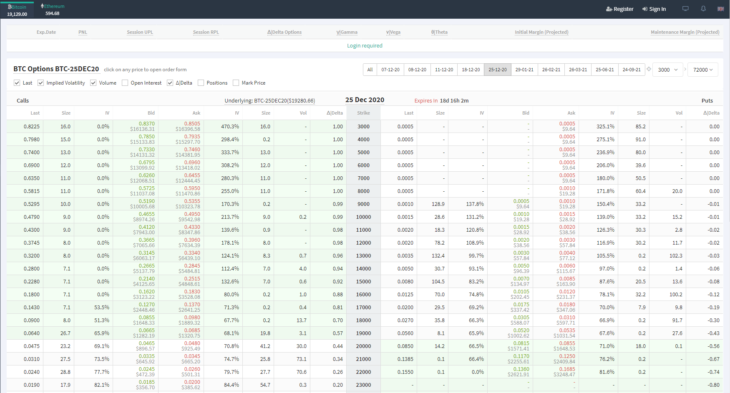

Let’s see an example of how bitcoin options look like. This is a screenshot of the Deribit bitcoin option trading platform. On the right side, you can see the call options (option to buy) and on the left side the put options (option to sell) at various strike prices (the price set today) for a predetermined date in the future (this is 2020 Dec 25 in our case). The bid and ask prices are the price you have to pay (bid) or receive (ask) when entering into a long (bid) or short (ask) position.

Trade with options just like with any other assets. Before entering into a transaction, make sure you understand the fees involved and the contractual obligations. You can use technical analysis to time your entry and exit level and use fundamental analysis to determine the market direction.

How to make profit with Bitcoin options?

There are several different trading strategies you can use to profit from bitcoin option trading. It really depends on your market views and risk management tools what you can profit from.

Bet on the future price of Bitcoin

For a little money, which is the option premium, you can bet on the future price of bitcoin. If you think bitcoin price will increase from the current price, you can buy an ATM call option – this will give you the right to buy bitcoin at the current market rate at a future date. Your profit will be the difference between the market price at execution and the exercise price at the exercise date minus the premium paid at start. This is similar to a buy and hold strategy.

If you think bitcoin price will decrease from the current price level, buy an ATM put option. But a put option, you buy yourself the right to sell bitcoin at the current price level. This means if you were right and bitcoin price indeed declined, you can still sell bitcoin at the prior, higher level, making you profit.

Bet on the volatility of Bitcoin

If you do not want to decide which way bitcoin will move, you can bet on volatility – the price changes in bitcoin. You can combine various options to get into a position that truly follows your trading strategy.

A straddle option position is a combination of buying a put and a call option at the same strike price. What does this mean? No matter which way bitcoin price moves, be it an increase or a decrease you will be profiting from the movement. The price will need to move at least as much you have paid for the premiums to result in a profit, but beyond that your profit is unlimited. Again, this is a price-neutral position, you do not need to know which way will the price move until, the price move as much as needed, you will gain profit.

There are several similar option combination position exists, the only thing you need to consider in these cases that you need to factor in the fees of the options into your calculations.

Generate cash flow with options

As a beginner, we would recommend you to start with buying options as that is the less risky way to get into option trading. However, when you are more comfortable in the options space, you can also start writing (selling) options yourselves.

In this case, you will enter into a contract as the seller of the option. Being the provider of the optionality, you have to execute the position if the option holder decides to do so. For example, if you sold a call option, while the option holder has the right to buy bitcoin at the strike price, you will have to sell the bitcoin at this rate, no matters what on the market. Similarly, if you sell a put option, you have to buy bitcoin at the strike price, no matter what is the market rate. In exchange, you profit from the premium paid upfront of the contract. You can decide later to close the short option with an offsetting long position, or if the market works in your favor, you can keep the position until expiration.

Note, however, selling option has a capped profit at the premium received but has an unlimited downside potential, so only use this trading strategy if you have sufficient risk management in place.

Margin trading with options

This is really only recommended for advanced traders. Just like in the case of margin trading on bitcoin, you can use leverage to get into bitcoin options. In this case, your potential profit and loss will be multiplied by the amount of leverage you use in your trade. Consider however that the underlying asset, in this case, is bitcoin – one of the most volatile asset in the world. Even a small movement in the underlying bitcoin price can result in huge price changes in the option position, multiplying that with leverage can give you enormous profit or catastrophic losses if no proper risk management is applied. Margin calls and liquidations are no fun, you are prompted to add more cash to your account if there is not enough liquidity and eventually your positions are liquidated if you cannot fulfill the margin call requirements.

Advantages of Bitcoin Options

Bitcoin options let to use leveraged positions with favorable risk/reward ratio. Certain option strategy has unlimited upside potential while only holding a limited downside risk. Unique strategies can be built to benefit any kind of market environment, that would be otherwise very expensive to be exploited without options. Getting into options does now require large capital allocation, you can start trading with bitcoin options as little as $10 on some markets.

Disadvantages of Bitcoin Options

While bitcoin options have some very favorable characteristics, it is important to see option market has its downsides as well. Compared to spot bitcoin trading, the bitcoin options market has relatively lower liquidity, this is especially true for the non-USD markets. Lower liquidity also means the trading spreads are higher compared to the spot market and providers also charge higher fees on option contracts than on spot positions.

Option trading is a complex business, and not suitable for everyone. It requires significant time and effort to understand the nuances of option trading, consider this before getting into option trading.

Top 6 Bitcoin Options Exchanges

FTX

FTX is a cryptocurrency derivative exchange offering European style options on Bitcoin. The bitcoin options as cash-settled, meaning you will be paid cash at expiration, not bitcoin itself. All options expire on their stated expiration date at 3 AM UTC time based on the underlying index price. The option fees are determined based on the monthly volume traded on FTX, ranging from 0 to 0.07%. You can use up to 100x leverage on the bitcoin option at FTX. FTX.com is the best option if you are looking for extremely high leveraged bitcoin options.

FTX is a cryptocurrency derivative exchange offering European style options on Bitcoin. The bitcoin options as cash-settled, meaning you will be paid cash at expiration, not bitcoin itself. All options expire on their stated expiration date at 3 AM UTC time based on the underlying index price. The option fees are determined based on the monthly volume traded on FTX, ranging from 0 to 0.07%. You can use up to 100x leverage on the bitcoin option at FTX. FTX.com is the best option if you are looking for extremely high leveraged bitcoin options.

Deribit

![]() Deribit was one of the first market place to offer physically-settled bitcoin options. This means at expiration, bitcoin options are settled in BTC, not USD or other fiat currency. Deribit offers European style options in BTC and ETH with various expirations from 1 day to 1 year ahead. This platform provides one of the biggest liquidity on the market. Deribit charges 0.015% as settlement fee beyond 0.03% commission fee, the minimum trade size is 0.01 BTC. Deribit is the best option if you are looking for a physical settlement and high liquidity in bitcoin options.

Deribit was one of the first market place to offer physically-settled bitcoin options. This means at expiration, bitcoin options are settled in BTC, not USD or other fiat currency. Deribit offers European style options in BTC and ETH with various expirations from 1 day to 1 year ahead. This platform provides one of the biggest liquidity on the market. Deribit charges 0.015% as settlement fee beyond 0.03% commission fee, the minimum trade size is 0.01 BTC. Deribit is the best option if you are looking for a physical settlement and high liquidity in bitcoin options.

Binance

![]() Binance is one of the few market participants offering American-style bitcoin options with a minimum contract size of 0.001 BTC. The expiry dates include extremely short terms, including 10 minutes, 30 minutes, 1 hour, 8 hours, and 1 day. You can only purchase options (going long), Binance does not offer shorting options. Binance options are cash-settled based on the BTCUSDT futures contract. There are no trading fees for bitcoin options at Binance, all the fees are built into the option premium. If you are looking for extra short terms, Binance bitcoin options are best for you.

Binance is one of the few market participants offering American-style bitcoin options with a minimum contract size of 0.001 BTC. The expiry dates include extremely short terms, including 10 minutes, 30 minutes, 1 hour, 8 hours, and 1 day. You can only purchase options (going long), Binance does not offer shorting options. Binance options are cash-settled based on the BTCUSDT futures contract. There are no trading fees for bitcoin options at Binance, all the fees are built into the option premium. If you are looking for extra short terms, Binance bitcoin options are best for you.

Quedex

Quedex is a Gibraltar based bitcoin futures and options trading platform offering bitcoin options with weekly, monthly, and quarterly settlement dates. Option trading fee is 0.04% no matter if you are a market maker or taker, with an additional 0.04% settlement fee on ITM options (ATM and OTM option settlement are free of charge). Options are European style options that are cash-settled at the expiration day at Fridays at 8:00 UTC time. Quedex is the best option if you are looking for cash-settled bitcoin options at low fees.

Quedex is a Gibraltar based bitcoin futures and options trading platform offering bitcoin options with weekly, monthly, and quarterly settlement dates. Option trading fee is 0.04% no matter if you are a market maker or taker, with an additional 0.04% settlement fee on ITM options (ATM and OTM option settlement are free of charge). Options are European style options that are cash-settled at the expiration day at Fridays at 8:00 UTC time. Quedex is the best option if you are looking for cash-settled bitcoin options at low fees.

OKEx

OKEx is a Malta-based cryptocurrency exchange offering cash-settled bitcoin options for both short term (daily, weekly) and long term (quarterly, bi-annually). The minimum trade size is 0.0005 BTC and exercised in a European style at expiration. The fees are determined based on a 30-day trading volume in a maker-taker fee model, ranging from 0.015% to 0.05%. OKEx provides one of the biggest liquidity on the bitcoin options market, it is the best option if you are looking for the best prices.

OKEx is a Malta-based cryptocurrency exchange offering cash-settled bitcoin options for both short term (daily, weekly) and long term (quarterly, bi-annually). The minimum trade size is 0.0005 BTC and exercised in a European style at expiration. The fees are determined based on a 30-day trading volume in a maker-taker fee model, ranging from 0.015% to 0.05%. OKEx provides one of the biggest liquidity on the bitcoin options market, it is the best option if you are looking for the best prices.

Huobi

Huobi is a Chines cryptocurrency exchange offering its services worldwide and being one of the biggest market players on the bitcoin options market beyond Deribit and OKEx. The European style call and put bitcoin options are cash-settled on a weekly, bi-weekly, and quarterly at 4 PM (UTC) on Fridays. They charge a fixed fee of 0.002-0.005 USDT for opening and closing positions based on if you are a market maker or market taker. Huobi is the best option if you are looking for large scale trades.

Huobi is a Chines cryptocurrency exchange offering its services worldwide and being one of the biggest market players on the bitcoin options market beyond Deribit and OKEx. The European style call and put bitcoin options are cash-settled on a weekly, bi-weekly, and quarterly at 4 PM (UTC) on Fridays. They charge a fixed fee of 0.002-0.005 USDT for opening and closing positions based on if you are a market maker or market taker. Huobi is the best option if you are looking for large scale trades.