How to earn Interest on Cryptocurrencies

Are you a long term crypto investor? Interest on cryptocurrencies has been designed for you! While you are holding bitcoin and waiting for the price to shoot to the Moon, you can make your crypto work for you.

Although this sounds very promising, there are a couple of things you need to be aware of to avoid scam and make a good profit. Let’s review how to earn interest on cryptocurrencies, what you need to look out for, and what the best place you can earn interest on your coins.

Earning Interest on Cryptocurrencies

Before jumping into the details, let’s review the most important definitions in this topic.

Compounding Interest

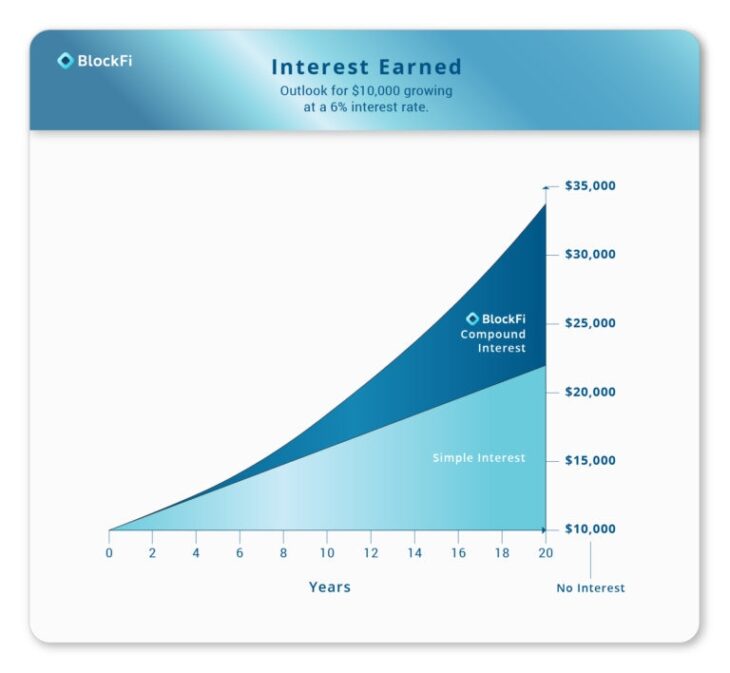

First and foremost you need to understand why interest on crypto is a HUGE thing. Have you ever heard about compound interest? According to Albert Einstein, it is the 8th wonder of the world. When you earn interest you get a payment on your principal.

In case you decide to reinvest this interest earned, you are using compound interest, which eventually can result in much higher earnings potential in the long run.

Combining compound interest with rising prices of cryptocurrencies can result in a truly unique form of investment.

Compounding Interest on Cryptocurrencies

Consider a simple term deposit, when you put into your deposit account and you earn interest during the time you keep your money in the bank.

The compounding part is working for dollar deposits, you fund your account with the principal, earn interest on a regular basis, you are reinvesting your earned interest and you are happy at the end. However the principal you have funded your account with stays in value the same.

You funded your account with 1000 USD, it will be 1000 USD at the end of the term deposit plus the interest earned. In case of a crypto interest payment, you also need to consider the price volatility.

If you funded your account with 1000 USD worth of BTC, in 3 months’ time it can quickly worth 3000 USD and during that time you also earn compounding interest!

Hence, you earn both from the rising prices and from the compounding interest. Two birds with one stone.

It is important to understand however that, cryptocurrencies are very volatile assets, their prices can change rapidly and with huge magnitudes. While you can profit from rising prices, you can also lose significant sums in case of the price of the crypto assets are declining.

Interest Payments on Cryptocurrency

How does cryptocurrency interest payments work?

How does cryptocurrency interest payments work?

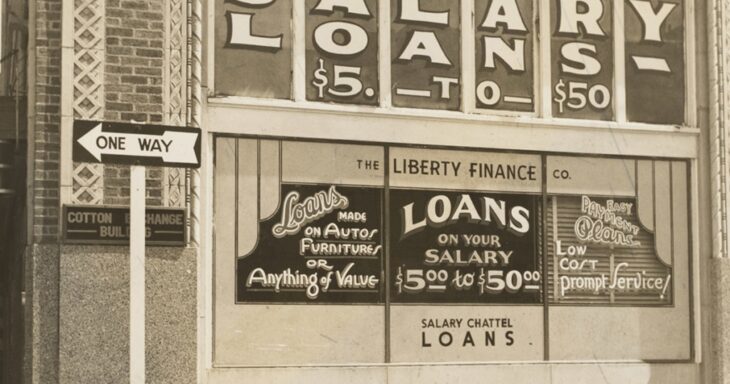

So you say you are interested in earning interest on cryptocurrencies. But the next question you would ask is where does all this money come from?

Well, if you are paid interest, somebody needs to finance that.

In this specific case, a loan borrower pays interest on a monthly/quarterly/annual basis based on the predefined agreement. You, as a lender, lend your money to receive the interest paid by the borrower.

I see your eyebrows lifted – so what guarantees that your hard-earned cash lent to some random individual will be paid back with interest? There comes to the picture of the third-party loan providers, who review the creditworthiness of the borrowers and facilitate the interest payments between the two parties for a small fee.

Bitcoin and crypto loans are all backed by the digital coins and the credit line is usually lower than the value of the coins offered for collateral. By now there are a couple of legit services that offers interest on cryptocurrencies and lending that our for individuals and small businesses.

Bitcoin Loans

Another important question is on the other side of the transaction: why would anyone like to borrow cryptocurrency instead of a traditional credit line?

There are a couple of aspects you need to take into account.

First, if you have invested in cryptocurrencies at some point and you have a long term bullish view on the price, you do not want to sell your coins before the price reaches your target. However, you may still need cash to finance your daily operations and expenses.

If you place your bitcoin as collateral for your bitcoin loan, you can still keep the upside potential of price appreciation but you still receive some cash in exchange for future interest payment.

The second most popular reason people turn to bitcoin loans is trading. In case you think the price of a crypto asset will fall you can consider shorting. When you are shorting a position, you need to borrow cryptocurrency first to sell it at a current market rate in the expectation you can buy it back at a lower rate and you make a profit between the sale and purchase price.

You can use a bitcoin loan, you borrow bitcoin, sell it immediately on the market, buy it back just before the loan expires and give back the amount. Your profit will be the difference in lower price purchase and higher price sale – if the market moved into a favorable to you.

And the third reason is the obvious privacy concerns: crypto loans are not visible on your credit history, not reported to authorities and even your immediate family does not see the transaction if you do not want to.

What are the legit Bitcoin Lending Platforms?

By now you can understand how bitcoin loans and interest payment work and looking for a lending platform where you can either borrow money or lend bitcoin in exchange for interest payment.

These bitcoin lending platforms work as a bridge between the lenders and borrowers. They handle everything related to the transaction, including a credit check, interest payments, collateral valuation, some also insure funds to make sure you receive your money back. However since your capital is at risk, it is important to choose a legit provider, because unfortunately there are many scams out there.

The good news is that there are a couple of ways you can verify and do due diligence to a lending platform to make sure you are not running into a scam.

- First and foremost: if something sounds too good to be true, probably it is not true. If a platform is offering extraordinary high APR (annual percentage rate) of return, for example, a daily (!) interest payment of 1+%, that you can almost certainly be sure it is a Ponzi scheme. In the case of a Ponzi game, the cash flow of the old clients are financed from the deposits of the new clients – until the pyramid collapse. You want to avoid this at all costs.

- Check for company background. If there is no information on the company founders and executives that is a good indication something is shady going on in the background.

- Make sure to check out the company’s social media profiles – if they have so and see if there is any activity there.

- Do not invest with anyone who does not even have a proper website and approaches you solely on email/Telegram/WhatsApp etc.

- Look for reviews online. You can see what others are talking about on a specific company on Reddit, BitcoinTalk threads, or on official review sites, like TrustPilot. If you see many users complaining, take it as a red flag and you should run.

Best Places to earn Interest on Cryptocurrencies

We have gathered here the best places you can earn money on your cryptocurrencies without worrying about being scammed.

Blockfi – Blockfi offers direct compound interest on crypto assets.

Blockfi has been on the market since 2017 and had managed to secure millions of venture back funding over the past couple of years to extend its business.

Using your crypto interest account you can earn up to 8.6% on your BTC, ETH, LTC holdings together with stablecoins such as USD Coin, PAX, and Gemini Dollar. Blockfi was the first and only platform to offer compound interest on crypto assets. On other lending platforms, you need to manually reinvest your earnings to gain access to compounding interest – Blockfi does this for you automatically. Your interest is paid out directly in cryptocurrency.

There is no minimum balance to earn interest on cryptocurrencies and you can also buy stablecoins using bank wire directly on Blockfi where you subsequently have the option to trade it against crypto assets. On the other side, however, you can only deposit up to 5 BTC with high-interest rate (6%), above that the APY drops to 3.2%. You can get 8.6% APY on stable coins only.

Blockfi charges a flat fee for withdrawals, which is higher for the first time and lowered to 0.0025 BTC / 0.0015 ETH after the second withdrawal. Withdrawals are limited to 100 BTC per day.

Nexo – Nexo is one of the safest platforms to lend cryptocurrency and earn money.

Founded by TechCrunch founder Michael Arrington in 2017 by now Nexo became of the leading market participants on the crypto lending market. They serve over 10 million users worldwide on the bitcoin loan side, in terms of investors they have paid out more than 10 million USD in interest payment to the 70k lenders they support.

You can earn up to 5% on crypto assets and 10% on stablecoins with the option to cash out your interest on a daily basis on Nexo. They have over 100 million USD in custody to cover any potential losses. On the high-yield savings account, you can earn interest on 13 different cryptos and you can also buy cryptocurrencies from fiat money and deposit to your savings account without leaving the platform.

The minimum holding period is only 24 hours and the minimum deposit is 0.001 BTC or equivalent in altcoins.

Although Nexo does not charge any additional fees, the interest rates on cryptoassets are lower compared to other platforms and you also need to pass a KYC process to verify your identity that can take some time.

Binance lending – Binance is one of the leading cryptocurrency exchange that recently introduced crypto lending in 100 different altcoins.

![]() The Hong Kong-based Binance has started its business in 2017 and by now become one of the biggest cryptocurrency exchange by daily volumes.

The Hong Kong-based Binance has started its business in 2017 and by now become one of the biggest cryptocurrency exchange by daily volumes.

Binance recently introduced cryptocurrency lending in 100 different altcoins, that also means you can earn money on your altcoin savings portfolio. They offer flexible deposits that you can redeem at any time and fixed deposits with higher profit options. They also run promotions from time to time where they offer a higher annualized interest rate only for a preset amount of coin portfolio. Flexible deposits earn 5.54% on BUSD (Binance’s own USD stablecoin), 5.48% on USDT, and 1.04% on BTC. Fixed-term deposits are available from 7 days up to 90 days and offering up 8% on Tether.

You also have the option to auto-transfer all of your available spot balance to the flexible savings account to make sure you are earning money even if you do not use your cryptos for trading.

Interest rates vary daily based on market demand, so it is a bit difficult to project your earnings in the long run. Although they have a support team, most of the cases they only respond with automated messages, so if you have a question you be better off Googling the answer for it.

Celsius Network – Celsius Network is a blockchain-based financial service network that aims to revolutionize how we see traditional financial services.

Founded in 2018 by Alex Mashinsky, the inventor of VoIP phone service, Celsius Network has grown into a platform servicing 50k members by now. It was on Forbes’ list of top 10 companies to watch in 2018 as a potential disruptor of the bank sector.

Their idea is to provide a zero fee environment for both lenders and borrowers, as they are matched against each other in a decentralized way. You can earn up to 12% APY with Celsius on the 25 different crypto assets and stablecoins they offer deposits for. They also have their own token, CEL, that can multiple your earnings by an additional 35%. Whatever commissions are collected from the borrowers, 80% of that is shared back with the users.

There is no minimum deposit on Celsius Network, you can start earning as low as 5 USD, also there are no changes in the yields if your deposits are increasing. At the same time, you can withdraw your funds any time from the platform.

Unfortunately, the Celsius Network is only available for mobile apps (both iOS and Android), but they do not have a web-based platform.

Crypto.com – Crypto.com is a full-service cryptocurrency platform, where you can buy, trade, spend, borrow and earn cryptocurrencies.

![]()

Crypto.com domain itself has a long history back before even bitcoin existed, but the company behind Crypto.com has just started to offer its services in 2018. The CEO of Crypto.com is Kris Marszalek, a serial entrepreneur with a couple of e-business in his background.

You can earn up to 8% p.a on your crypto holdings in 50+ different altcoins and up to 12% p.a. on ten different altcoins. Interests are paid out weekly in the crypto you provided the deposit for. Using the platform’s own native coins, CRO you can earn up to 18% p.a. for 3 months long holdings.

There are a lot of different services built on Crypto.com, including an exchange for fiat coins, a trading platform for pro traders, a VISA card for bitcoin spendings, and a lending platform where you can both lend and borrow cryptocurrencies.

Crypto.com is not available for residents of the United States, Switzerland, and Hong Kong due to local regulations.

Conclusion

There is nothing magic in earning money with your cryptocurrencies even beyond trading and just hodling it. Interest on bitcoin, stablecoins, and altcoin deposits are getting more and more popular as they have a predictable earnings yield with a potential upside gain in case of price appreciation. Several providers on the market offers earnings on your crypto, however, you need to be careful when making a choice, as there are many scams there.

Just bear in mind, if something is too good to be true, it is probably not true. Take a look at the best bitcoin lending providers we recommend where you can earn interest on crypto in an easy and transparent way.